additional tax assessed by examination

The selection of your return or account for audit does not mean you will owe additional tax. Compulsory sale means i the sale of real estate for less than the amount owed to the mortgage lender or mortgagor if the lender or mortgagor has agreed to the sale commonly referred to as a short sale and ii the first sale of real estate owned by a financial institution as a result of a judgment of foreclosure transfer pursuant to a.

The total intangible property tax burden of any individual or business cannot exceed three percent.

. Many of our examinations do not require a visit to your home or business and can be resolved by phone. The practical answer lies in a procedural policy at the IRS called the examination. Additional taxes usually come in the form of an audit or an underreporter notice called a CP2000.

Two broad penalty areas apply to preparers. Cities counties and townships can levy taxes on intangible property. A tax addition of 50 percent of the interest due on underpayment will accrue until paid or assessed.

Underreporter attributable to Tax Motivated Transactions TMT interest will accrue and be assessed at 120 of underpayment rate in accordance with IRC 6621c a. If you are making additional payments for a previously filed 1040X select Payment PlanInstallment Agreement or Balance Due for 1040 payments or Health Care Individual Responsibility payments. Balance due or Overpayment Taxes - Line 16 Page 1 b.

Or a proposed tax assessment such CP2000 or an Examination assessment for your federal income tax return. Entities that are not subject to the individual federal income tax such as. The floating rate applies to underpayments and late payments.

The tax rate is determined by the amount of the tax levy to be raised from all or part of a taxing district and the districts taxable assessed value. 1 the tax rates of the taxing jurisdictions in which your property is located and 2 the propertys assessed value. If you think that you will owe additional tax at the end of the examination you can stop the further accrual of interest by sending money to the IRS to cover all or part of the amount you think you will owe.

Counties may tax such property at a rate of up to 075 percent and cities or townships may impose an intangible property tax of up to 225 percent. If you do not file your petition on time the proposed tax will be assessed a bill will be sent and you will not be able to take. There is no penalty assessed on the taxes while under the tax deferral.

However if the test reveals a problem you will be requested to have an eye specialist licensed in the state of Florida complete a Report of Eye Examination HSMV 72010 and submit it to the department prior to. Consequences for failure to file a tax return are outlined in the Florida Statutes. Passing a vision examination is required.

We routinely audit tax returns and business tax records to ensure compliance with Virginia law. Money market funds are exempt from this disclosure as are fund shares used exclusively by defined contribution plans ie qualified under Section 401k 403b 457 of the IRC or similar arrangements ie Section 817d of the IRC concerning variable contracts. The test may be taken at our office at no additional charge.

35 ILCS 2001-23 Sec. 6695 provides for seven distinct penalties that may be assessed on a tax return preparer for actions related to disclosures and client. Once the agreement is in force no additional penalty will be assessed however 1 interest will accrue.

Upon passing the vision test you can complete the renewal process. Even though the IRS can legally audit you until the three-year assessment statute ends in practice it rarely works this way. Florida Department of Revenue quotes the floating rate each January 1 and July 1.

HR Block has been approved by the California Tax Education Council to offer The HR Block Income Tax Course CTEC 1040-QE-2355 which fulfills the 60-hour qualifying education requirement imposed by the State of California to become a tax preparer. When delegating duties to subcommittees andor officers the Board and the trust committee continue to be responsible for. IRS individual tax form used to.

EITC or the additional child tax credit. First time applicants need to schedule a time for taking the driving test and pass both the driving and written test. An examination of these penalties starts with the definition of a tax return preparer.

Interest charges are assessed from the date the tax return is due until full payment has been remitted. Managements willingness to take corrective action should be reflected in the Report of Examination. Andor appoint additional committees and officers to administer the operations of the trust department.

Two things determine the amount of your property tax bill. Audits frequently conclude with no additional liability found or a refund to the taxpayer. A listing of additional requirements to register as a tax preparer may be obtained by.

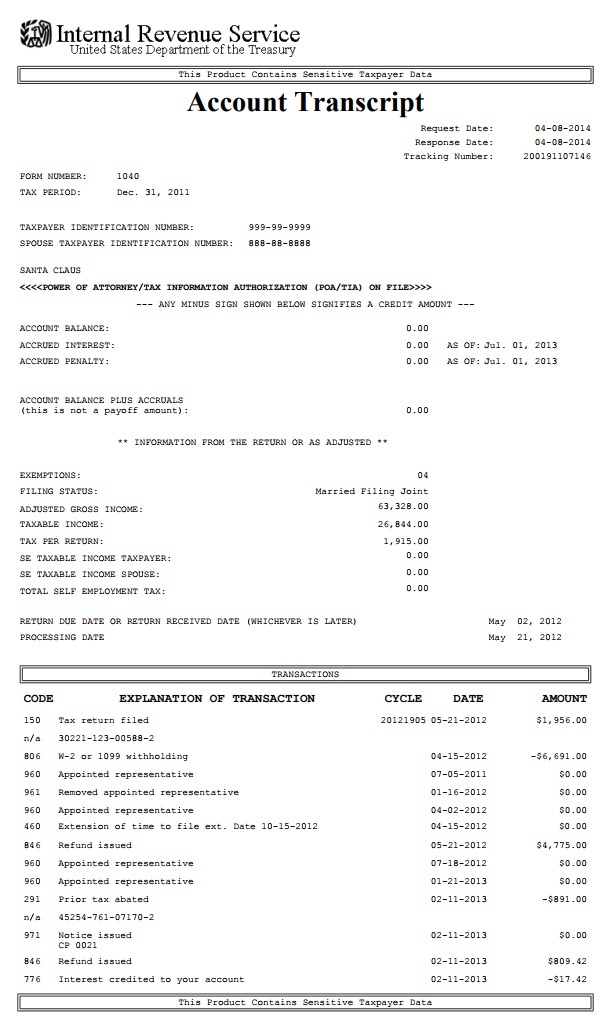

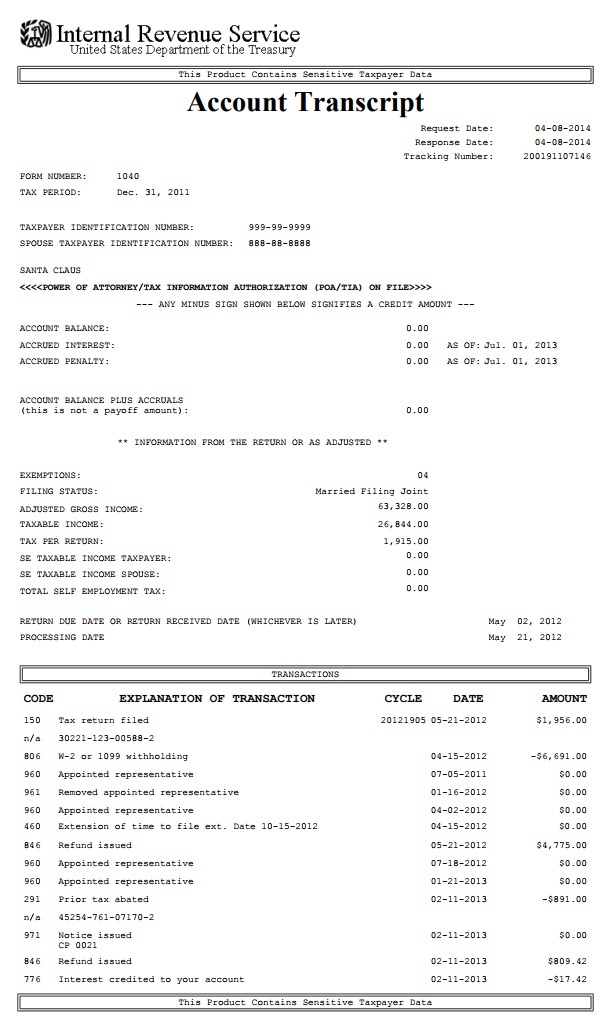

Nta Blog Decoding Irs Transcripts And The New Transcript Format Part Ii Taxpayer Advocate Service

The Official Guide For Gmat Quantitative Review 2017 With Online Questions Gmat Gmat Exam Writing Assessment

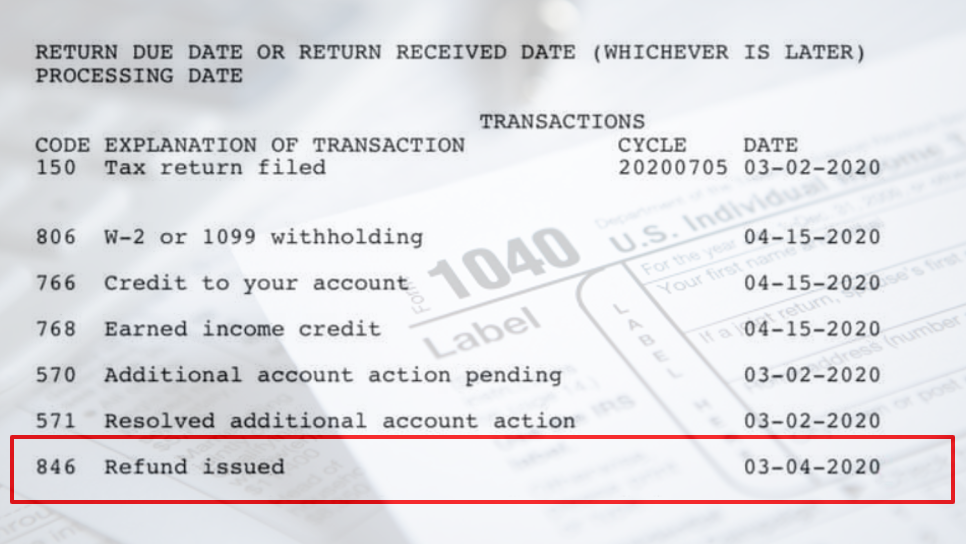

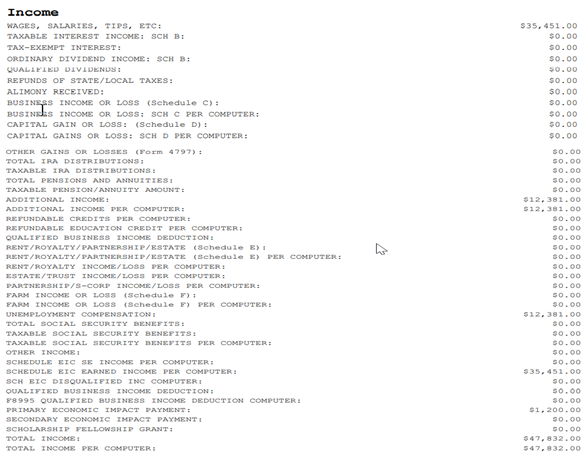

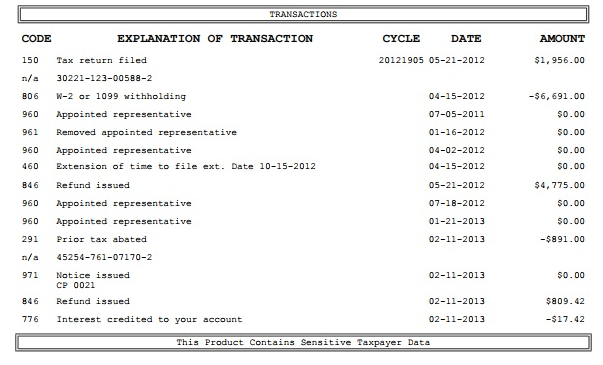

Meaning Of Irs Tax Transaction Codes On Wmr Irs2go And Account Transcript For Your Tax Return And Refund Status 150 151 152 203 420 421 570 846 898 971 1121 1161 Aving To Invest

Irs Code 290 Solved What Does It Mean On 2021 2022 Tax Transcript

Irs Code 290 Solved What Does It Mean On 2021 2022 Tax Transcript

Nta Blog Decoding Irs Transcripts And The New Transcript Format Part Ii Taxpayer Advocate Service

Property Tax Appeals When How Why To Submit Plus A Sample Letter

How To Read An Irs Account Transcript Where S My Refund Tax News Information

![]()

Irs Code 290 Solved What Does It Mean On 2021 2022 Tax Transcript

Irs Transaction Codes And Error Codes On Transcripts

Revision Exercise With Key Notes O Level Poa Assessment Book Tuition Syllabus O Levels

20 2 5 Interest On Underpayments Internal Revenue Service

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block

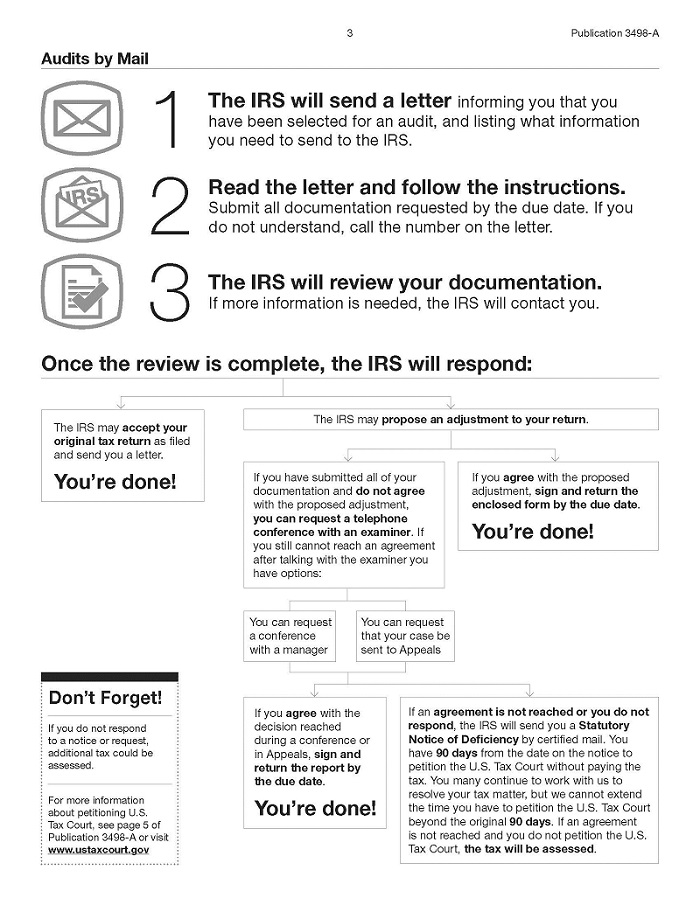

Audits By Mail Taxpayer Advocate Service

How To Read An Irs Account Transcript Where S My Refund Tax News Information

10 Task List Templates Word Excel Pdf Templates Task List List Template Word Template

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

Nta Blog Decoding Irs Transcripts And The New Transcript Format Part Ii Taxpayer Advocate Service

About Tutor Mr Wynn Khoo For More Information Contact Admin Poatuition Com Sg Http Www Poatuition Com Tel 81356556 Tuition Tuition Centre Tutor